One week to go – call for action on alcohol and tobacco in Budget 24

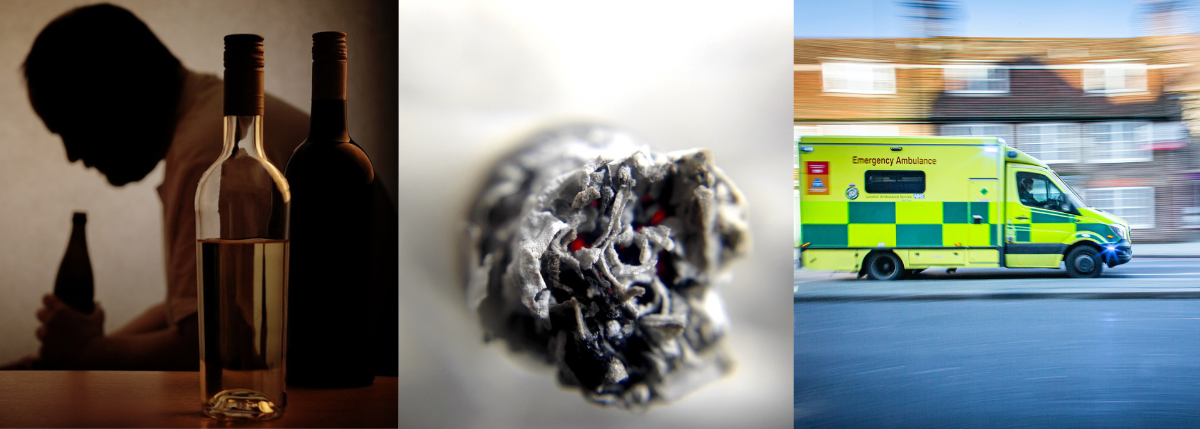

Fresh and Balance are calling for decisive action to reverse harm from alcohol and tobacco in this year’s autumn budget.

They join health leaders across the country calling on the Chancellor to use the budget as a way of improving the nation’s health while also plugging highly publicised gaps in the public purse.

Tobacco and alcohol are straining the public resources, costing the North East nearly £4 billion a year combined – with £2.35bn costs from smoking and £1.5 billion from alcohol. This includes costs to families and individuals, the NHS in healthcare and hospital admissions, social care for local authorities, costs to emergency services in crime and disorder (alcohol) and costs to the economy through sickness and lost employment prospects.

Not only does alcohol use place a significant burden on society but action to reduce smoking will be limited without action to reduce the harms caused by alcohol, including measures to reduce affordability.

Alcohol duty changes in August 2023 marked the first increase in over a decade. Treasury estimates indicate that cuts and freezes had cost the public purse around £1.8 billion in revenue every year since 2012, despite almost a million alcohol-related hospital admissions a year and record levels of alcohol deaths.

Fresh and Balance is a regional programme dedicated to reducing the harm from tobacco and alcohol in the North East of England.

The North East has a unique declaration for a smokefree future with a clear vision: “A smokefree future, free of the death and disease from tobacco, is needed, wanted and workable. This would improve the health and wealth of our region’s most disadvantaged communities more than any other measure”.

Balance has launched “Reducing Alcohol Harm”, a ground-breaking blueprint calling for urgent national action to tackle the significant impact of alcohol on health, social care, crime, disorder, workplaces, and the economy which has been backed by Directors of Public Health, Police and Crime Commissioners, the NHS Integrated Care Board for the North East and North Cumbria, and the Mayor of the North East Combined Authority

Ailsa Rutter OBE, Director of Fresh and Balance, said: “We are hopeful of moves now by the Government to raise the age of sale for tobacco. In the next few months MPs may have one of the biggest chances they will ever have to prevent our biggest cause of cancer, stop the start of young smokers and create a better life free of addiction for our children.

“However, a lack of action around alcohol over a decade is costing the country and costing our health, with hospital admissions and deaths at a record level. Meanwhile the alcohol and tobacco industry make huge profits without contributing to this cost.

“The Budget is an opportunity to boost the health of the nation for healthier and more productive communities so that poverty and inequalities are reduced, productivity is boosted, our workforce is healthier, more resilient and less likely to be out of work and reliant on the state, and demand on health and social care will be reduced.”

Fresh and Balance have responded to HM Treasury’s call for evidence ahead of the Autumn Budget 2024 with a series of key asks, supporting the recommendations from Action on Smoking and Health and the Alcohol Health Alliance. These are set out below.